Ask a lender to choose between 2 options: originate ONE $3 million small business loan or originate TEN $300 thousand small business loans, which do you think the lender would choose? Although the total originated amount is the same, the lender would select the $3 million option. Why is that?

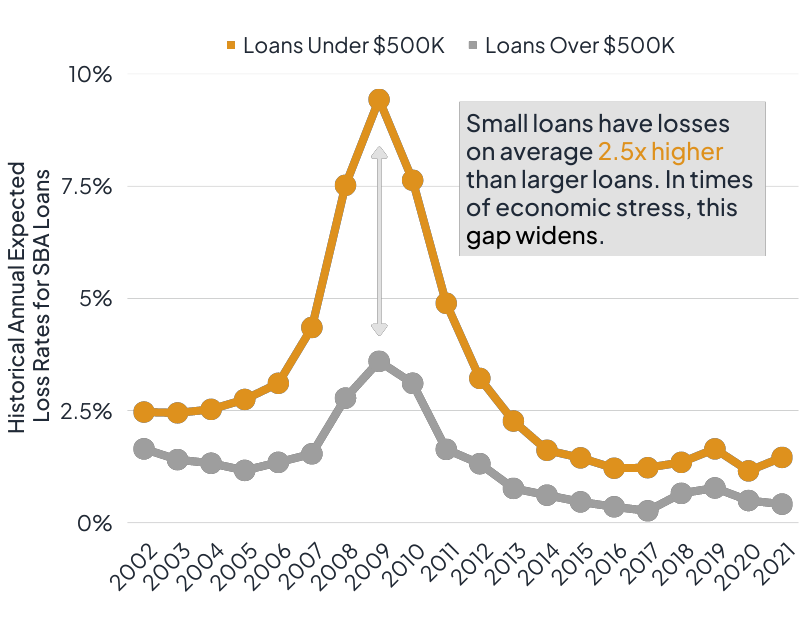

One main reason for this is the credit risk associated with small business loans under $500 thousand. Small dollar small business loans have, on average, two and half times the credit risk of larger small business loans. In times of economic stress, this gap widens even further. Due to this, lenders often shy away from these smaller small business loans.

The lenders that do target the smaller loan sizes often attempt to mitigate the increased credit risk with stricter underwriting guidelines and processes. With stricter guidelines, comes more time and resources invested into each individual loan. This creates an unfeasible business unit for financial institutions due to the cost of origination. So how can institutions maintain high quality credit risk analysis of each loan while making the origination process cost efficient for the lender? The answer is a score-based approach, specifically the Lumos PRIME+ Score which was built with small dollar small businesses in mind.

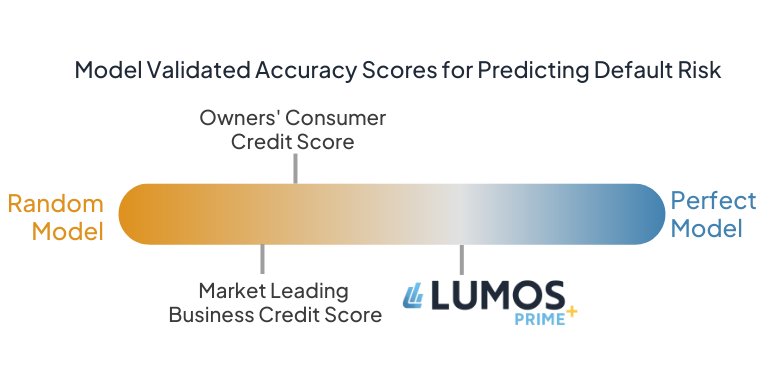

Financial institutions currently rely on consumer credit and small business credit scores to quantify small business risk. There are major limitations to the applicability of consumer credit scores to the performance of small businesses. The score accurately portrays the borrower’s consumer spending habits, such as paying bills on time, however consumer scores do not perform well when analyzing business performance. Just because a borrower has a high consumer credit score, does not mean the business itself will cash flow to support business debt. Because of this, lenders may turn to a small business credit score. Though you may think this would perform better at predicting small business performance, that is not the case. Current market small business credit scores are either too reliant on consumer credit data, or they are built with data not specific to small business lending. Building in other loan products and market segments creates a score that is too vague for small business lending.

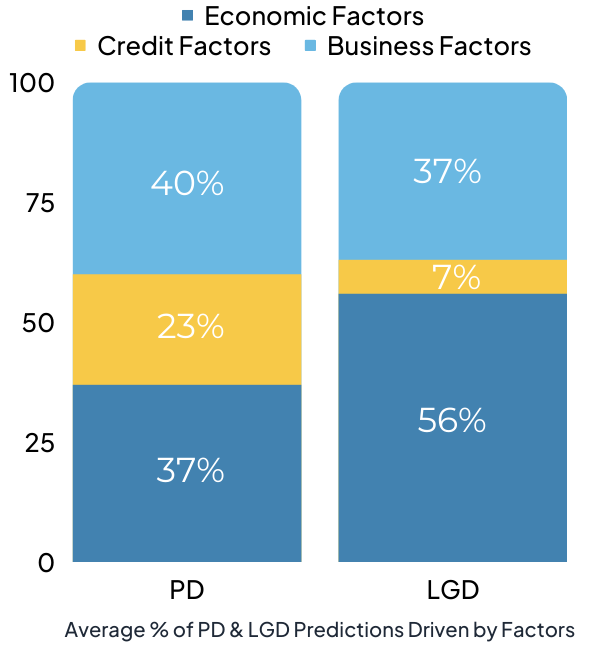

In addition to these scores providing little contribution to predicting probability of default (PD), they also do not contribute any loss given default (LGD) predictions. Although it is often not the first component of credit risk that lenders think about, LGD plays a significant role in predicting credit performance. The combination of PD and LGD create a total expected loss (EL), which is the most accurate way to quantify loan performance. The over reliance on consumer credit and the lack of consideration for LGD in predicting performance significantly reduces the accuracy of these scores for small business lending.

Rather than relying on the scores historically available for small dollar small business lending, the Lumos PRIME+ Score was created to predict expected losses over the following twelve months for small business loans under $500 thousand. The Lumos Prime+ uses three decades of small business loan performance data combined with machine learning algorithms to deliver PD and LGD predictions specific to small dollar small business loans. Multiple macroeconomic factors are layered into loan history to quantify the impact to EL. Prevailing conditions such as employment data, interest rates, inflation data, and others at the time of origination account for the impact of the current economy on expected business performance. Unlike consumer credit scores or many existing business scores, Lumos Prime+ actually considers the impact of the current economy – booming or recessionary. By adding historical small business performance data and macroeconomic data to the existing consumer credit score, the Lumos PRIME+ Score delivers an expected loss prediction of each small business that is more accurate and fairer than other scores.

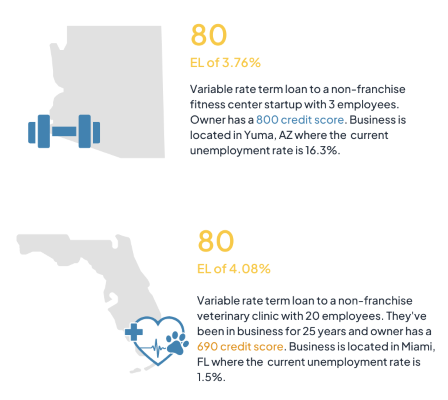

The Lumos PRIME+ Score ranges from 0-100 and is mapped to an expected loss percentage which represents the next 12 months of loan performance. As an example of the impact that the additional data found in the Lumos PRIME+ Score has on predicting default, here are 2 scenarios:

Per the examples, both of these loans have a PRIME+ Score of 80 even though the borrower’s consumer credit scores differ drastically. If a lender was relying on just the consumer score to make the decision, option 1 would have likely been the only one approved, depending on the risk tolerance of the lender. However, once you consider other factors such as industry, business size, years in business, and macroeconomic indicators, both loans actually have very similar risk profiles. Again, the goal with the PRIME+ score is to accurately predict credit risk, similar to how a manual underwriting process would. Often times factors such as industry and business plan, borrower experience, loaction, and economic environment are included in manual underwriting. Rather than go through the process of compiling these metrics together into a manual credit memo, the PRIME+ score quantifies these factors and condenses them down into one score.

Upon back testing the PRIME+ Score, the data showed that 69% of all performing loans would have received a Lumos Prime+ Score above 80. At 69%, Lumos Prime+ outperforms other market leading scores which only predict approximately 51% of performing loans. Therefore, the PRIME+ Score allows lenders to approve approximately 18% more small dollar small business loans without sacrificing credit quality.

Overall, the Lumos PRIME+ Score is intended to increase the confidence in small dollar small business lending and help lenders tap this vast market. Built by bankers, this score offers insight and predictability of loan performance that no other scores on the market currently do. If you are looking to grow your small dollar small business portfolio but aren’t sure how to accomplish this, start with the PRIME+ Score.