Lumos transforms complex, often siloed data into actionable insights to expand and optimize small business loan origination and risk assessment. Backed by expert financial literacy, we provide your institution with standardized, automated metrics, powerful decisioning models, and efficient processes with rich, curated data at the heart of it all.

End-to-end solutions that fit into various areas of the lending cycle

End-to-end solutions that fit into various areas of the lending cycle

Advanced Automated Intelligence to Streamline Approvals and Minimize Risk

The Lumos PRIME+ scoring model improves underwriting efficiency and provides a more accurate and fairer risk assessment for small business loans less than $500 thousand. The Lumos PRIME+ score:

Lumos PRIME+ significantly outperforms competing models’ accuracy allowing lenders to approve more loans to small businesses. Finally, there is a solution for banks to more completely serve their small business clients.

The Lumos Business Report and the small business Qualification Grade enable financial institutions to effectively manage risk during the early stages of the opportunity and improve underwriting efficiency for individual loans. Equip your financial institution with Generative AI and Machine Learning to accelerate loan growth, improve operational efficiency, effectively manage risk, and deliver consistency in the small business loan origination process.

The Lumos Business Report and Qualification Grade offer intelligent automation and predictive modeling for increased productivity and profitability.

Boost the small business loan origination process with:

Overcome inefficient and lengthy manual processes when assessing small business credit worthiness by leveraging intelligent automation to accelerate credit risk analysis and improve profitability.

Drawing upon our financial industry expertise, we are proficient in the building of small business performance models for lenders. If you are looking to mitigate risk, streamline decision making, and increase efficiency, we can provide custom models built specifically for your institution. We incorporate your unique data sets with our own proprietary small business and economic performance data. Our data-backed predictive analytics help you:

Our models are built following the FDIC’s Model Risk Management guidance. Customized models will help you grow your business and provide a distinct advantage over your competitors.

Actionable Insights to Safely & Soundly Grow your SBA Loan Portfolio

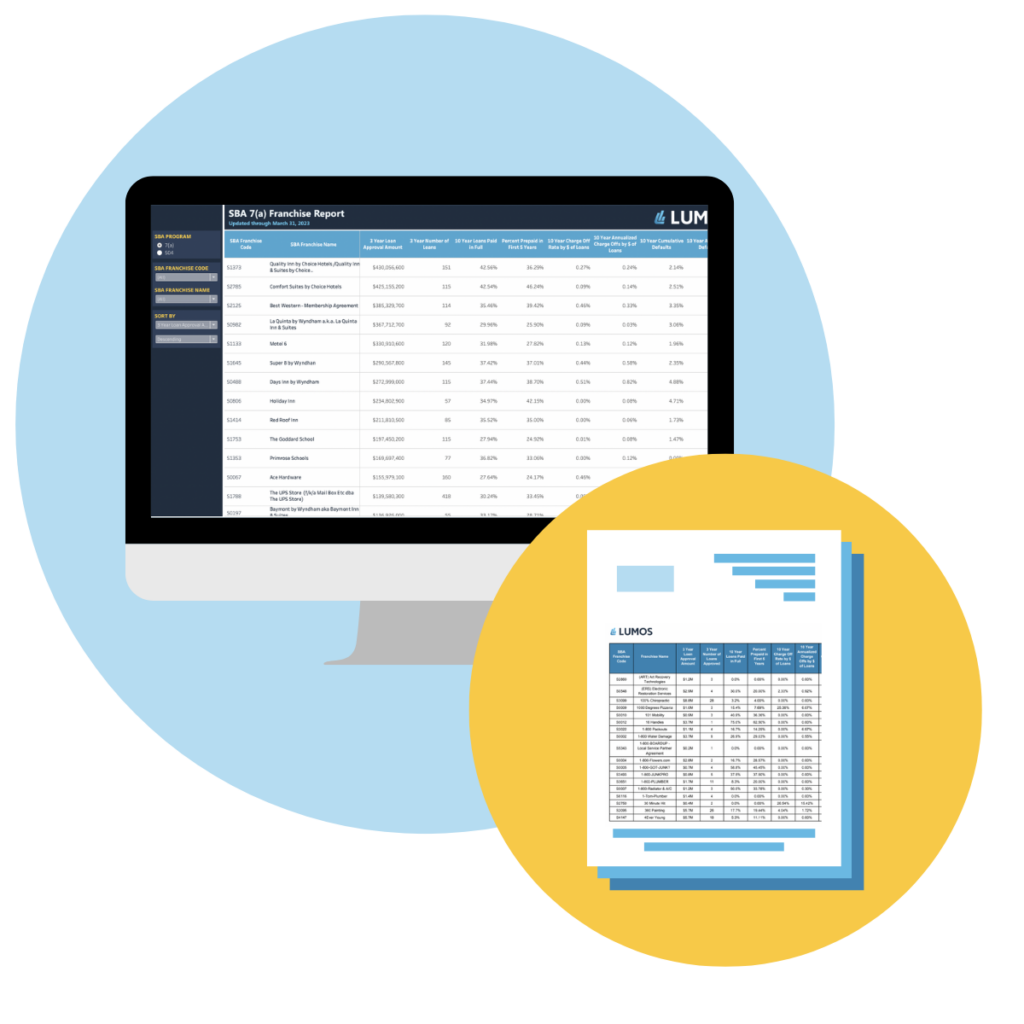

Start making strategic decisions with greater clarity. You can access our proprietary dataset via a centralized, cloud-based platform to explore dashboards with real, usable data and visually intuitive information. The Lumos Portal provides a single source of truth for:

Break free from data silos, uncover growth opportunities, and reveal the insights that matter in one convenient place.

Lumos and FRANdata bring powerful small business lending franchise analytics to financial institutions to mitigate risk and uncover new opportunities in one central location. Combining FRANdata’s rich franchise data and proprietary FUND™ score with Lumos’ small business lending performance data the Franchise Lending Insights product provides the tools to:

Through the Lumos Portal, financial institutions can access the Franchise Lending Insights dashboard to better understand the opportunities and risks of the small business lending market.

Gain access to clean and standardized SBA performance data segmented by NAICS and Franchise over the past 10 years. Stay informed, make data-driven decisions, and uncover opportunities for growth and success in the small business lending landscape. The report:

SBA NAICS and Franchise Loan Performance Report is available for $2,000 annually.

Tailored Lending and Data Services for Business Growth

With decades of experience, we emphasize creative problem solving and deep analysis. We’re here to clear away the cobwebs and help you fully leverage your data. By collaborating with us, you gain:

Focus your energy on growing your institution rather than combing through and sorting your disparate data.

106 Market Street, Suite 300

Wilmington, NC 28401

United States