Portfolio Insights

Proactive Small Business Loan Portfolio Management

Quantify loan risk, enable a more robust monitoring of loan performance, and assess the overall health of the portfolio with Lumos Portfolio Insights.

Identify Potential Risks

Implement Preventive Measures

Maximize Profitability

Proactively identify higher risk areas of your portfolio.

Lumos Portfolio Score helps financial institutions assess risk and identify potential problem loans in their small business loan portfolio. Streamline risk management, optimize portfolio management, and analyze potential concentration risk to inform future decisions.

Effortlessly monitor your portfolio’s trends through the Portfolio Insights Dashboard.

Learn More

Performance & Benchmarking

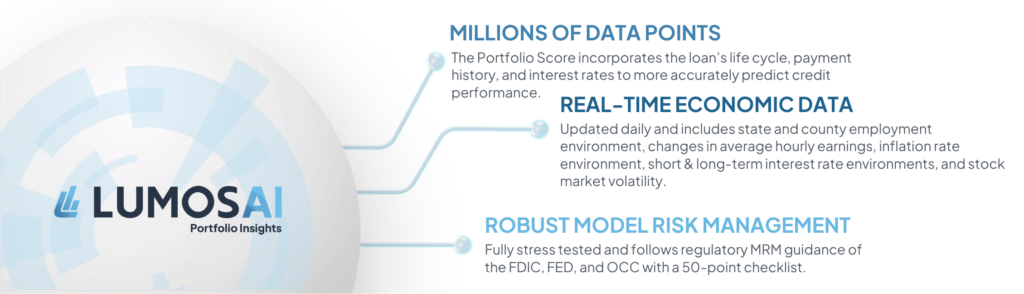

Predict and benchmark your portfolio performance with 20+ current local, state, and national economic factors – in real time.

Risk Migration Trends

View portfolio risk migration with trends based on your scoring frequency.

Credit Concentrations

Evaluate your loan portfolio as a whole or categorize it by industry, geography, loan product, size, and other factors.

Analyze Top Risk Factors

Understand your portfolio risk and see the top factors driving your credit performance.

Accurate Prediction of Credit Losses Across Loan Lifecycle

Safeguard the profitability of your small business loan portfolio

Forecasting Credit Losses with 3 Decades of Performance Data

We leveraged 3 decades of small business performance data with cutting edge machine learning algorithms to build the Portfolio Score. The Lumos Portfolio Score predicts expected credit losses over the next 12 months for small business loans and lines of credit up to $5 million.

Hundreds of individual credit scorecards power PD & LGD predictions and allow for the discovery of complex, non-linear relationships between economic, business & loan factors.

Loan Losses on a Scale of 0 to 100

Representing the expected loss % over the next 12 months for a small business loan in your portfolio.

Every 5 point decrease represents a doubling of loss risk.

Predictive Models You Can Trust

Effective Portfolio Management Requires Reliable Risk Measurement

The Lumos Small Business Economic Index forecasts the expected small business credit losses using the current economic environment. The Lumos Portfolio Score can determine your small business loan portfolio risk and its relationship to historical and broader economic risk. How will your small business loan portfolio perform against the backdrop of the broader economy?

Explore the Lumos Economic Index Resource Page to Learn More

Evaluate your loan portfolio as a whole or categorize it by industry, geography, loan characteristics, and understand the top risk factors.

Utilize the Portfolio Insights Dashboard for streamlined portfolio analysis. Easily assess credit concentrations and obtain a quick snapshot of your portfolio’s overall health. Efficiently pinpoint high-risk loans through simple filtering and drill-down options for swift decision-making.

Lumos Portfolio Insights provides customized results with valuable insights to minimize credit losses & maximize proftitability.

Economic climates are rarely certain; proactive loan portfolio risk assessments is not a best practice; it is necessary for sustainable performance

Start proactive portfolio management in four easy steps…

1. Data Collection

During implementation we will work with you to securely send us your loan tape. Your data is in safe hands with Lumos. Learn More about how we keep your data safe.

2. Predictive Model Results

Once we receive the data we will run the loan tape through our cutting edge machine learning model with real-time economic data.

3. Final Deliverable

Access your current and historical results through your custom, interactive dashboards. Additionally, your results will be delivered in Excel and CSV formats.

4. Ongoing Risk Monitoring

Portfolio scoring on a recurring cadence that meets your needs.

Minimize Credit Losses | Maximize Profitability with

Minimize Credit Losses and Maximize Profitability

Lumos Portfolio Insights provides valuable insights for lenders to protect their portfolios and minimize credit losses, ultimately maximizing profitability.