Increase approvals while declining fewer good loans

Improve lending efficiency and scale operational costs

Identify more high risk loans and mitigate risk

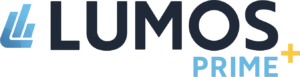

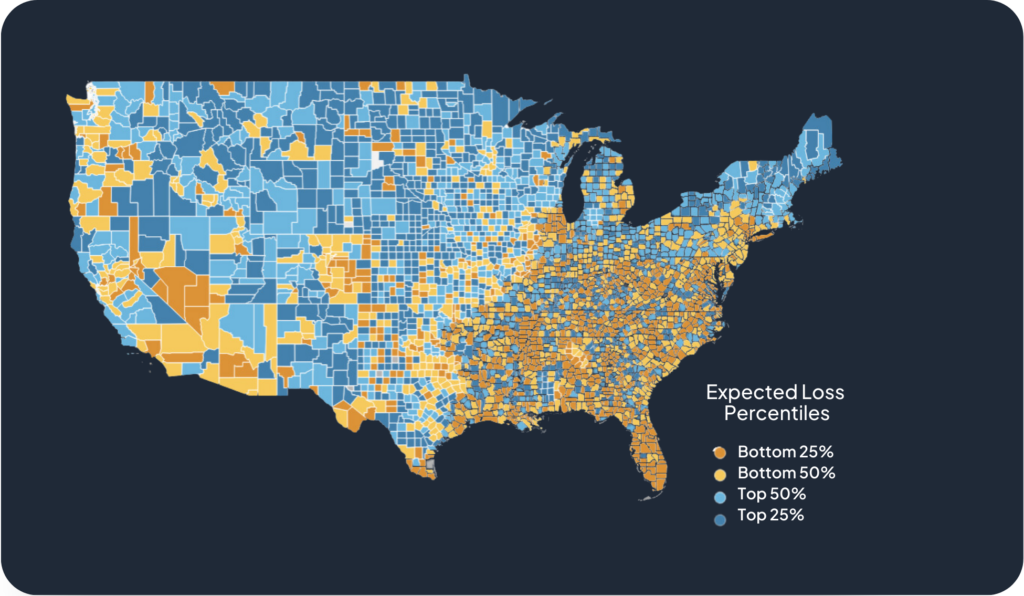

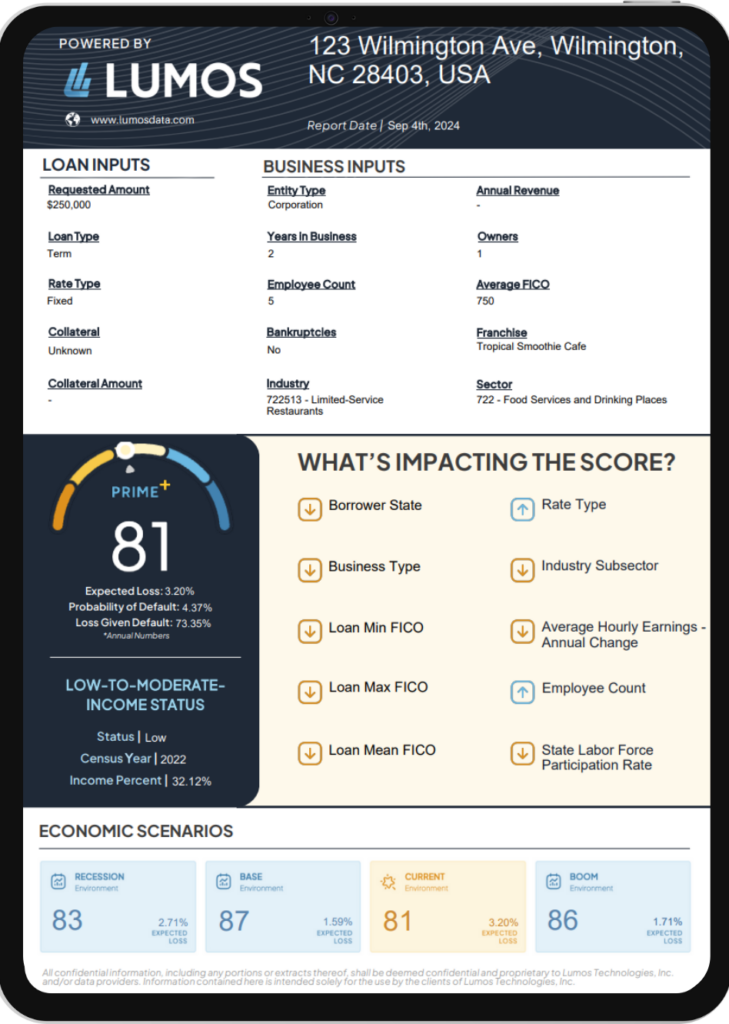

PRIME+ maps to a expected loss and is a quantifiable risk measurement that aligns across key functions at your financial institutional.

Advanced machine learning algorithms used to predict credit losses with dynamic weightings based on relationships between economic, credit, and business factors.

Streamline the Small Loan Origination Process with the PRIME+ Score

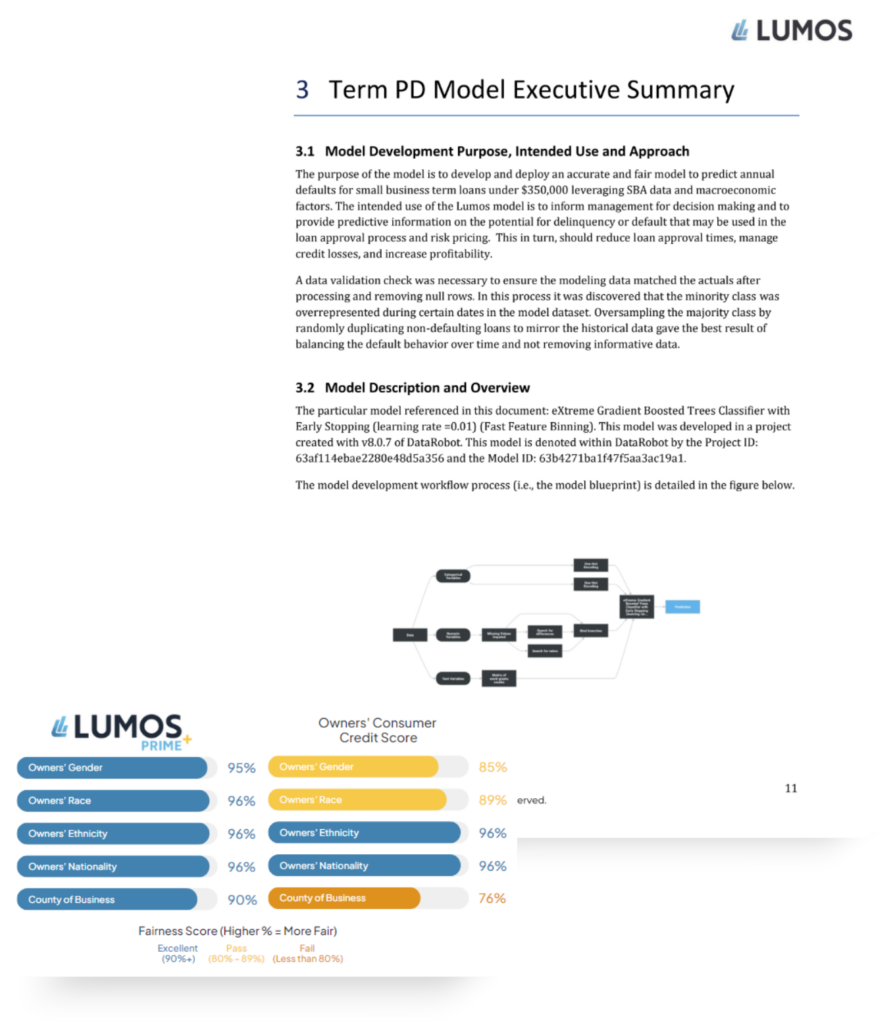

Our model risk management process follows modeling best practices and is aligned with FDIC and OCC regulatory guidelines.

Minimize Credit Losses | Maximize Profitability with

Minimize Credit Losses and Maximize Profitability

Boost loan growth, assess credit risk, and enhance efficiency with the PRIME+ Score

106 Market Street, Suite 300

Wilmington, NC 28401

United States