This report, published by Lumos Data, provides insights into the latest trends of the U.S. Small Business Administration (SBA) 7a loan program. The SBA plays a vital role in supporting small businesses by offering financial assistance through loan guarantees. Understanding these trends helps to gauge the health of the small business landscape.

This quarterly report dives into key data points from the most recent SBA updates to analyze lending activity, loan size distribution, and participation by different industries and lenders.

What's inside this report

This report explores the SBA data through a variety of statistics and graphs to provide a comprehensive picture. Here’s a glimpse of what you’ll find:

- Loan Volume and Trends:

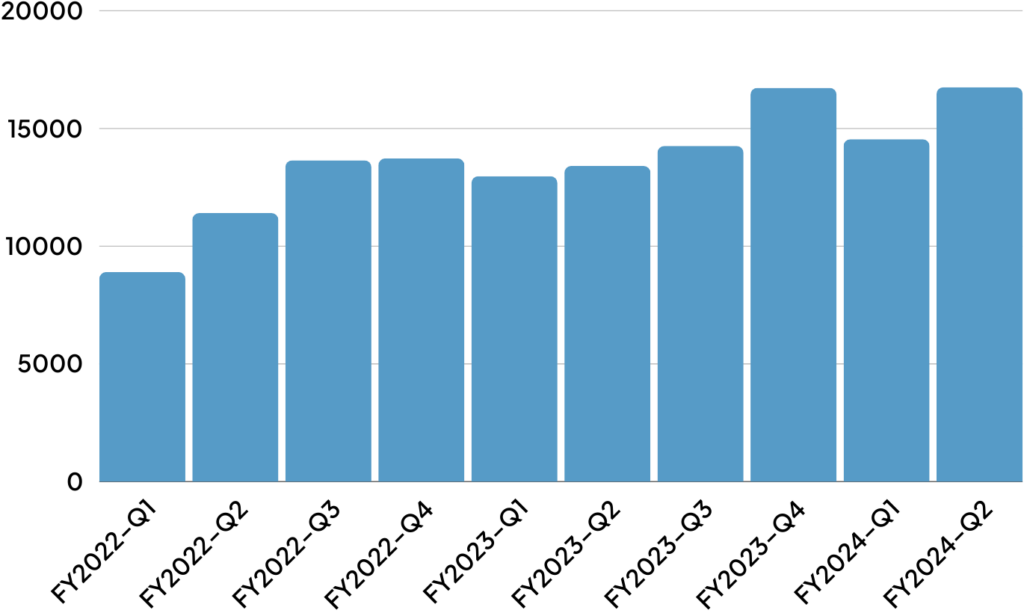

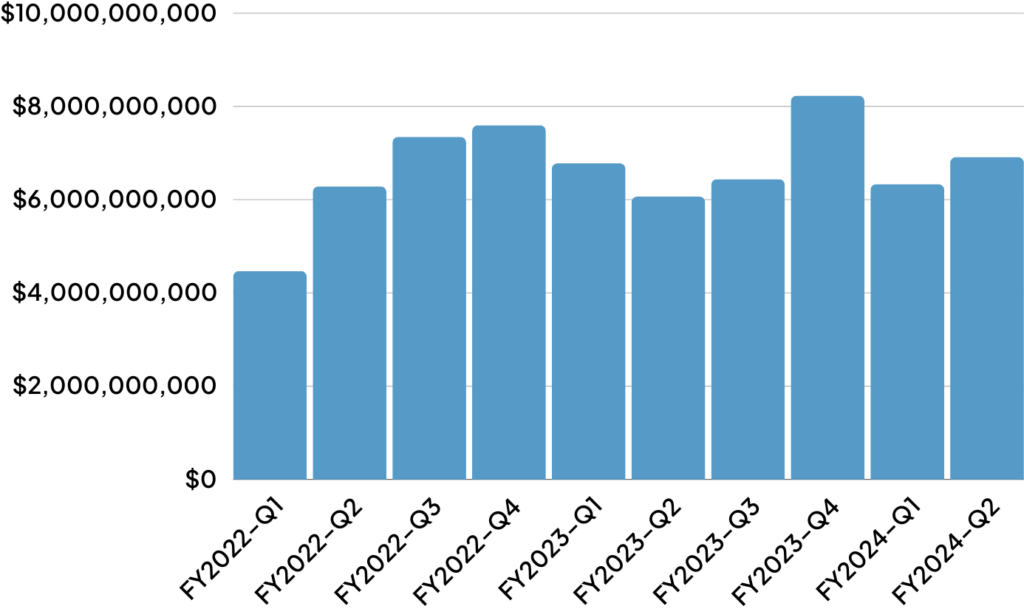

- Total loan volume approved by the SBA by number and gross approval amount over the last 10 quarters.

- Loan Size Distribution:

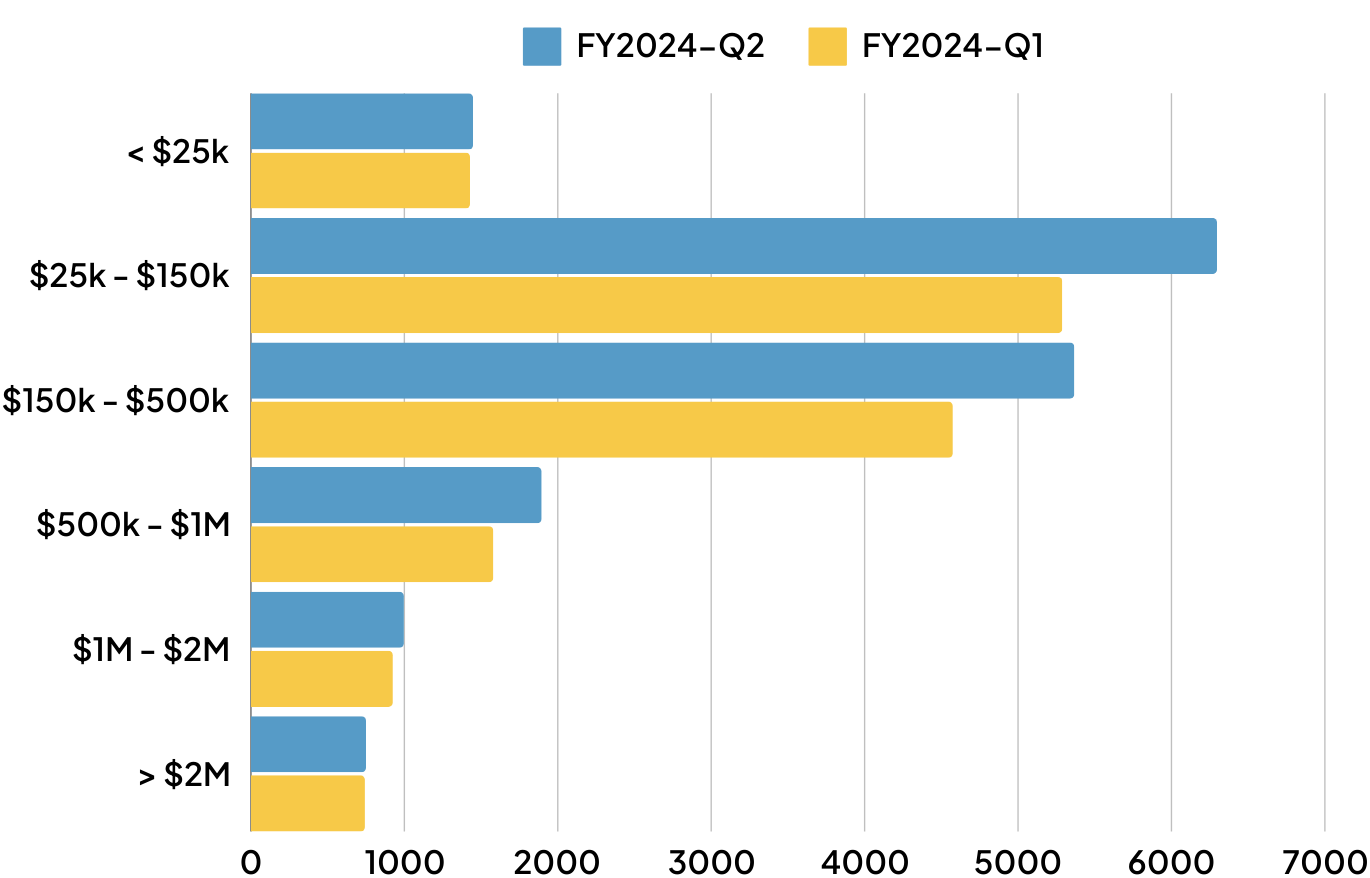

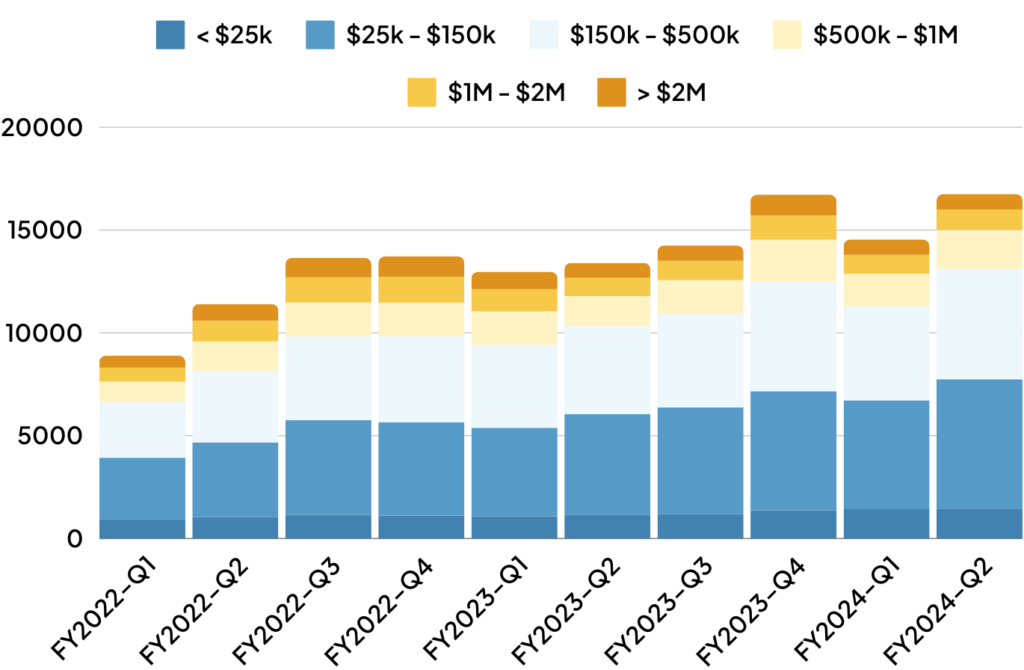

- Quarterly Analysis of the number of loans by approval amount size over the last 10 quarters.

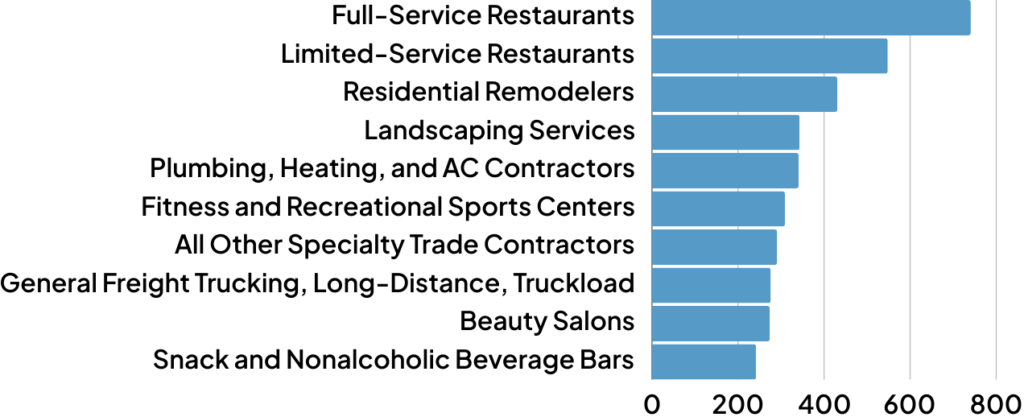

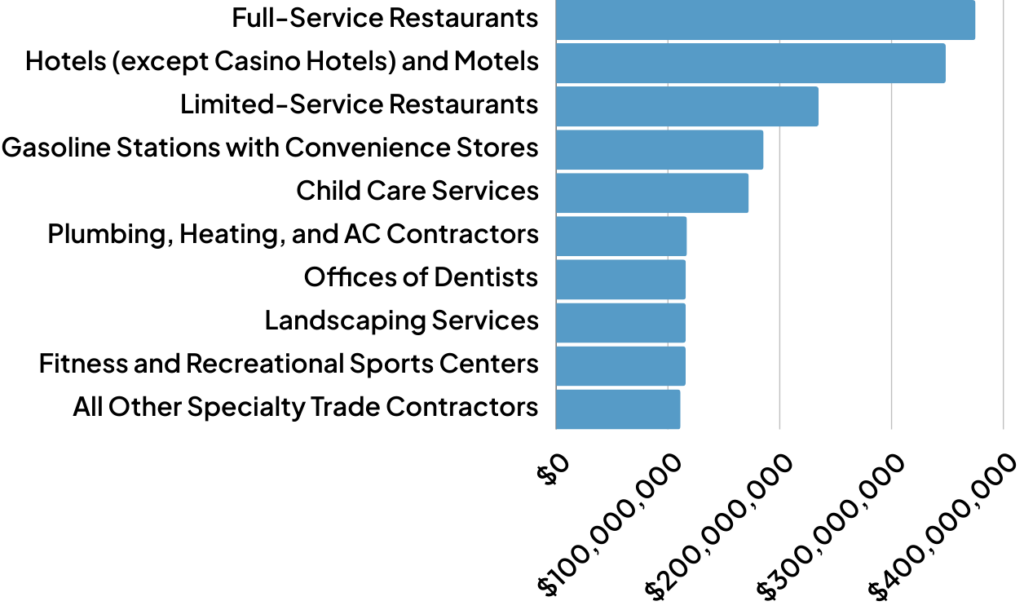

- Top Industries:

- The Top 10 Industries by Number of Loans and Gross Approval Amount in the last quarter.

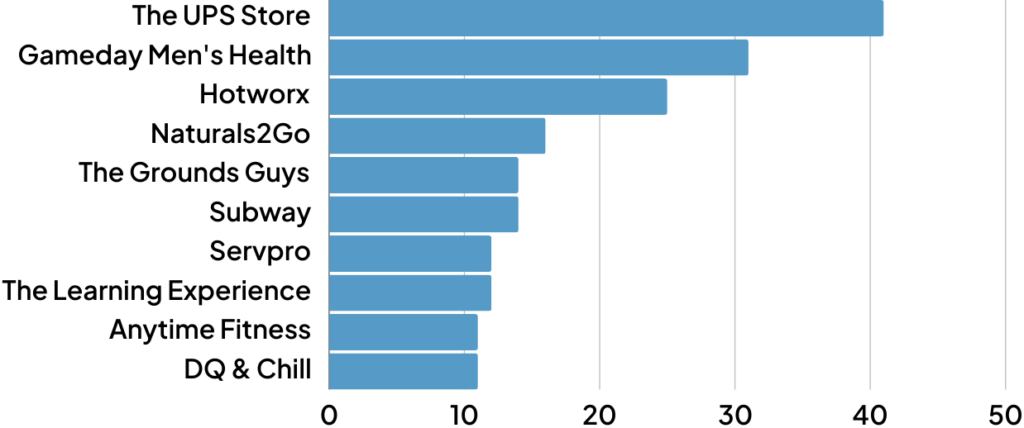

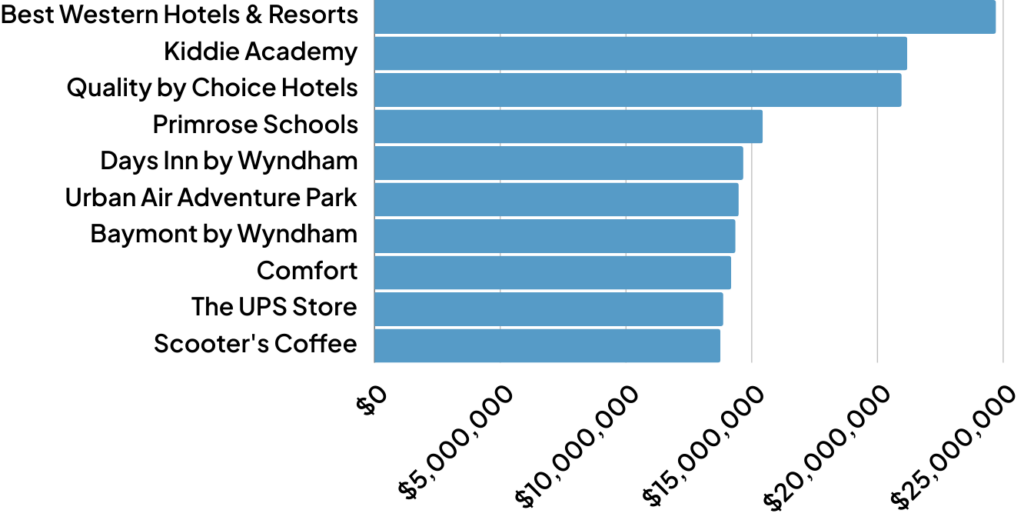

- Top Franchises:

- The Top 10 Franchises by Number of Loans and Gross Approval Amount in the last quarter.

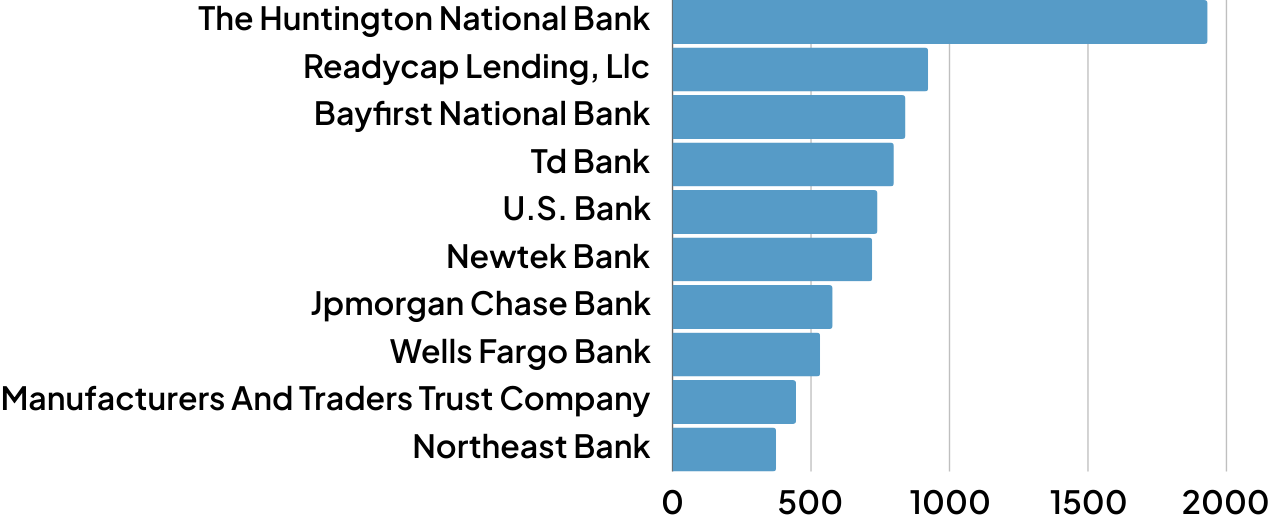

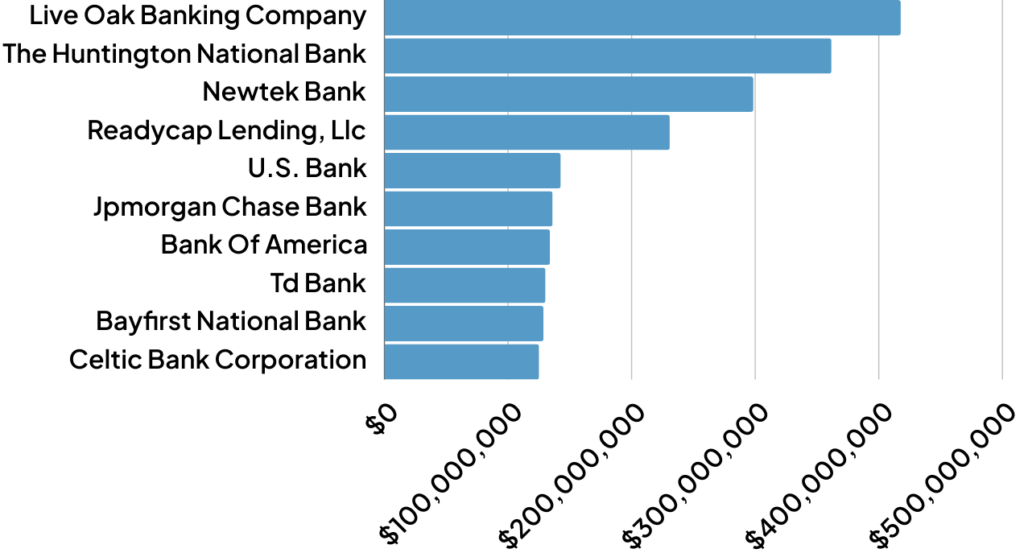

- Top Lenders:

- The Top 10 Lenders by Number of Loans and Gross Approval Amount in the last quarter.

SBA 7a Performance Overview FY 2024 - Q2

SBA 7a Loan Volumes & Trends

Quarterly Insight by Number of Loans

Quarterly Insight by Gross Approvals ($)

SBA 7a Loan Size Volume & Trends

Loan Size Comparison of Last 2 Quarters

Loan Size Comparison of Last 10 Quarters

SBA 7a Industry Volume & Trends

Top 10 Industries by Number of Loans

Top 10 Industries by Gross Approvals ($)

SBA 7a Franchise Volume & Trends

Top 10 Franchises by Number of Loans

Top 10 Franchises by Gross Approvals ($)

SBA 7a Lender Volume & Trends

Top 10 Lenders by Number of Loans

Top 10 Lenders by Gross Approvals

What Can Lumos Offer You?

Lumos’ products reflect our mission to transform complex, often siloed data into actionable insights. Backed by expert financial literacy, we provide your institution with standardized, automated metrics, powerful decisioning models, and efficient processes with rich, curated data at the heart of it all.

Advanced Automated Intelligence to Streamline Approvals and Minimize Risk

- Lumos PRIME+ Score

- Improve underwriting efficiency with a more accurate and fairer risk assessment for small business loans less than $500 thousand

- Lumos Business Report

- An automated business report that offers real-time information and predictive modeling for increased productivity and profitability

- Portfolio Insights

- Obtain a comprehensive overview of predicted portfolio performance with the ability to categorize by industry, geography, and product.

Actionable Insights to Safely and Soundly Grow your SBA Loan Portfolio

- Small Business Lending Insights

- Gain access to our proprietary dataset through our dashboards with real, usable data and visually intuitive information

- Franchise Lending Insight

- Lumos and FRANdata bring powerful small business lending franchise analytics to financial institutions to mitigate risk and uncover new opportunities in one central location

- SBA NAICS & Franchise Report

- Gain access to clean and standardized SBA performance data segmented by NAICS and Franchise over the past 10 years